Turn Your Unused Gold into Instant Cash – A Seller’s Guide

Silver has long been regarded one of the most reliable assets, a hedge against inflation, and a way to obtain liquidity throughout financial emergencies. With gold prices continually changing, offering your where to sell gold could be a clever decision—if you know getting the most effective price. Understanding the facets that determine gold's value, alongside crucial strategies, can help you maximize your profit.

Understanding Gold's Industry Value

Silver costs are pushed by international demand, geopolitical tensions, currency strength, and financial uncertainties. The buying price of silver is standardized in the global market and quoted in per-ounce measurements. To comprehend its market value, monitor stay gold prices through dependable tools, such as Kitco or Bloomberg, which update prices in real-time.

Data reflect that gold rates may differ significantly. For instance, the worth of just one ounce of silver surged from around $1,500 in mid-2019 to over $2,000 by 2020 due to financial instability during the pandemic. Staying conscious of the market improvements could right affect the quantity you obtain whenever you sell.

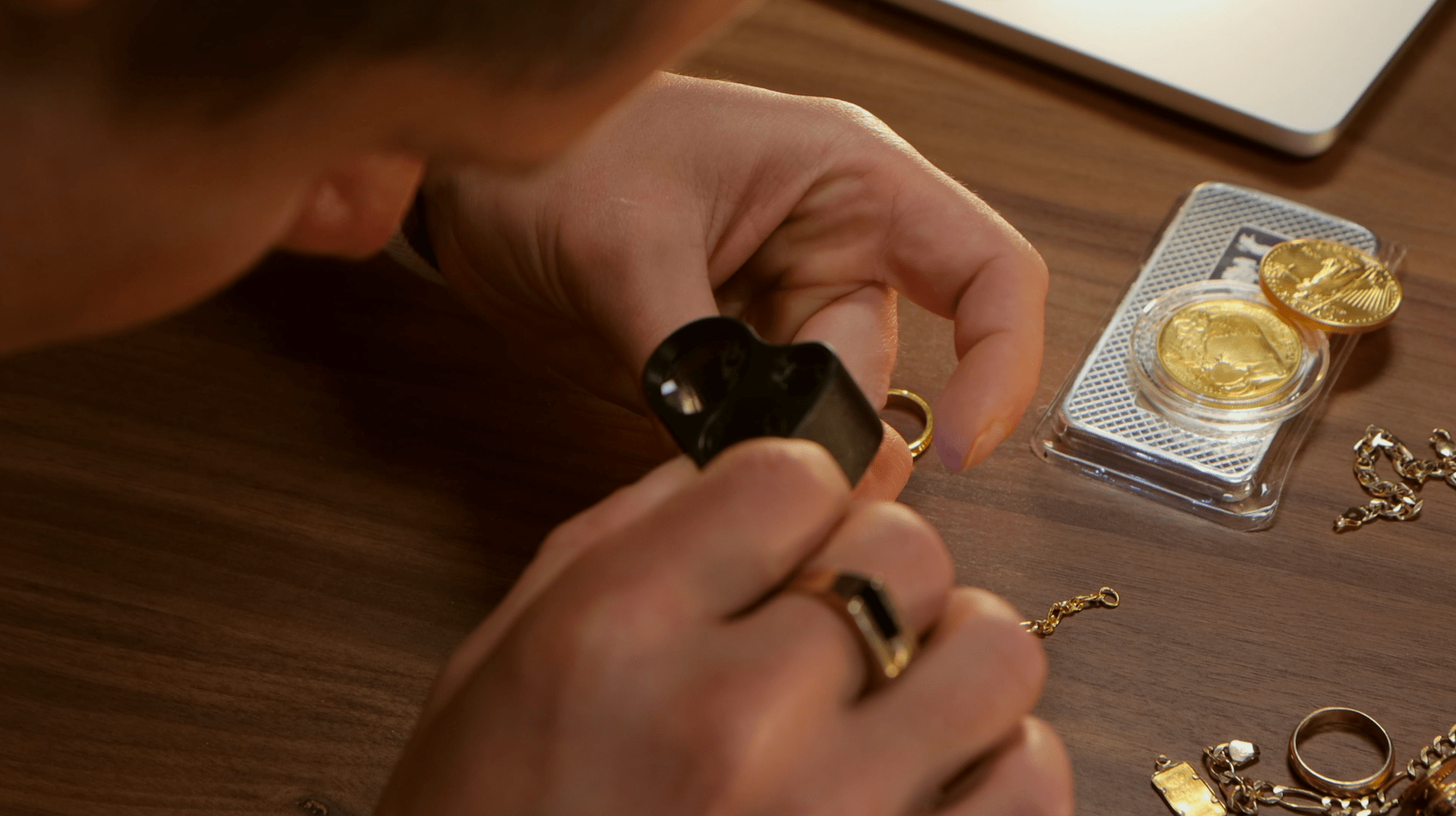

Measure the Love of Your Gold

The karat (K) system measures the love of silver, with 24K being 99.9% genuine gold. Silver pieces such as jewellery or ornaments tend to be alloyed with different materials to improve durability, decreasing their true gold content and value. For example, 18K silver contains 75% silver and 25% other metals.

When you offer, assure you know the love of one's silver by examining the karat stamp or having it tested by a skilled appraiser. Transparency in purity and weight is crucial for calculating the absolute most precise price.

Pick the Proper Function of Offering

Not totally all offering possibilities produce exactly the same return. Offering your silver on line to respected customers, such as for example bullion exchanges or particular silver traders, frequently provides greater rates than pawnshops or jewellery retailers. Study shows that pawnshops might present 10-20% less than silver merchants due to raised income margins.

Additionally, avoid “silver parties” or unverified buyers providing money offers, as they may undervalue your gold. A 2018 report outlined that standard silver sellers paid consumers around 15% a lot more than relaxed buyers.

Negotiate Predicated on Burn Price

The melt price shows the price of your gold following it's melted down and refined into natural gold bullion. Vendors should emphasis on this price, derived from weight and purity, as a standard all through negotiations.

Armed with familiarity with the existing gold value and melt value, confidently negotiate with buyers for a good offer. Examine multiple estimates to ensure the most useful deal.